FOR IMMEDIATE RELEASE

Auction Results: Mixed-quality Rubies

LONDON, 12 DECEMBER 2024 – Gemfields announces the results of an auction comprised of mixed-quality rough ruby held during the period 25 November – 11 December 2024.

Highlights: December 2024 Mixed-Quality Ruby Auction

- Total auction revenues of USD 46.2 million.

- 97 of the 102 lots offered for sale (comprising 167,865 carats) were sold (95%).

- A lower quantity of ‘premium’ rubies on offer was the key driver of the lower auction revenues.

- Average price per carat reached a record high for our mixed-quality ruby auctions, alongside some softer prices and thinner bidding.

- Mining operations in Mozambique remain unaffected by ongoing civil unrest following the contested election.

Adrian Banks, Gemfields’ Managing Director of Product & Sales, commented:

“Despite ongoing economic challenges in China and geopolitical turbulence worldwide, the results of this auction represent a positive outcome under the current market conditions. These results reaffirm the stability of demand for Gemfields’ rubies, with prices for fine-quality aligning well with the limited supply of these rare and precious gemstones.

Encouragingly, new entrants with well-developed supply chains placed successful bids in this auction, highlighting a positive outlook across the quality spectrum. While we did observe some softer prices and thinner bidding, the average price per carat reached a record high for our mixed-quality ruby auctions, with the withdrawal of a lower-quality lot having only a limited effect.

Mozambique poses a number of material operating challenges at present, including as a result of the contested election, the arising civil unrest and the associated supply chain and logistics interruptions. Gemfields’ priority remains the safety and security of our employees and contractors. We are grateful that, thus far, our mining operations have remained unaffected and we praise our circa 1,600 colleagues in Mozambique for their ongoing efforts in this regard. We wish the country and its citizens peace and prosperity and we are committed to making every effort within our means to further those goals.”

The rough rubies were extracted by Montepuez Ruby Mining Limitada (“MRM”, which is 75% owned by Gemfields and 25% by its Mozambican partner Mwiriti Limitada). The proceeds of this auction will be fully repatriated to MRM in Mozambique, with all royalties due to the Government of the Republic of Mozambique being paid on the full sales price achieved at the auction.

The auction lots were made available in Bangkok for private, in-person viewings by customers. Following the viewings, the auctions took place via an online auction platform specifically adapted for Gemfields and which permitted customers from multiple jurisdictions to participate in a sealed-bid process.

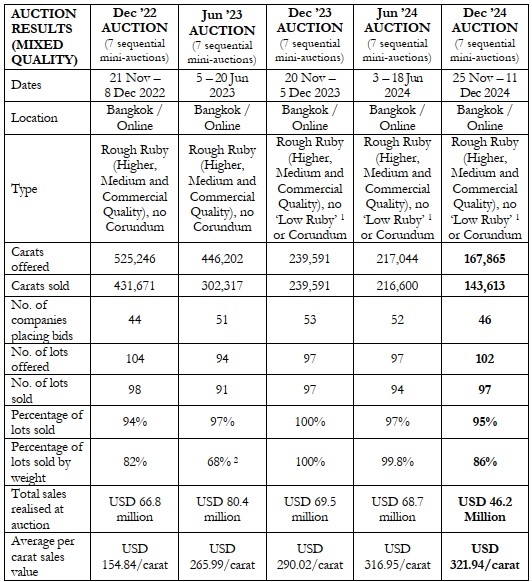

The results of the five most recent Mixed-Quality MRM ruby auctions are summarised in the table below (and earlier results are available at www.gemfieldsgroup.com):

1 – The ‘Low Ruby’ category was not offered at the December 2023, June 2024 or December 2024 auctions.

2 – One lot of 26,806 grams (representing some 30% of the total weight offered) remained unsold at the June 2023 auction. As a result, the average price per carat realised at this auction was considerably higher than it would have been had this lot also been sold. These gems were then sold at the September 2023 commercial quality ruby auction.

The specific auction mix and the quality of the lots offered at each auction vary in characteristics such as size, colour and clarity on account of variations in mined production and market demand. Therefore the results of each auction are not always directly comparable.

In addition, Kagem Mining Limited (“Kagem”), the Zambian emerald mining company in which Gemfields owns 75%, notes that a legal claim has been filed against it in Zambia by Kagem’s emerald mining competitor Grizzly Mining Limited, its sister company Pridegems Mines Limited and their majority owner, Mr Abdoulaye Ndiaye. The claim relates to alleged unlawful occupation by Kagem of an area known as “Kamakanga House” and conspiracy to injure business reputation and goodwill. Gemfields and Kagem believe that these claims are entirely without merit. Kagem (which had previously filed its own claim in Zambia against Grizzly, Pridegems and others in mid-November 2024 in relation to another area known as the “BISMA licence”) is in the process of preparing a robust defence in conjunction with its legal advisors.

-ENDS-

Further information on Gemfields Group Limited can be found at:

To join our investor mailing list, please contact us on:

ir@gemfields.com

For any press enquiries, please contact Helena and Albertina:

helena.choudhury@gemfields.com / albertina.namburete@gemfields.com

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) no. 596/2014 which forms part of domestic UK law pursuant to the European Union (withdrawal) act 2018 (“MAR”).